Thursday, September 24, 2010

(There’s a good reason why bullion traders and investors have nicknamed the COMEX the CRIMEX. Read Robert Moore’s essay below to see why. Moore, a frequent contributor to the Rick’s Picks forum, says bullion bankers have leveraged the commodity exchange’s liberal rules to perpetrate a fraud that would land you or me in jail. RA)

In 2004, two young men named Robert “Buddha” Gomez and James Nichols fleeced thousands of people to the tune of $21 million by selling them “paper” automobiles. Here’s a link to more on this fascinating story by Car and Driver’s John Philips. These two hucksters swindled thousands of people into paying real money for nonexistent cars that were part of the fabricated estate of a fictitious, deceased eccentric millionaire, who declared in his will that these cars were only to be sold to “decent, churchgoing people” at unheard of bargain-basement prices as low as $1,000.

If Gomez and Nichols had known what was good for them, they would have studied the COMEX gold and silver futures market a little more closely before embarking on their little adventure into the exciting world of fraud. We all know that a futures contract is merely a paper promise to deliver a quantity of bullion (or some other commodity) for a pre-determined price at some future date. This is analogous to the paper promise to deliver “miracle cars” at some future estate settlement date; and as long as the promise to deliver can be sold to a willing buyer, then the scam can continue in perpetuity.

Gomez and Nichols’ scheme collapsed and they were both hung out to dry when the need to deliver real cars to settle these purchase agreements came due. In the gold and silver markets, by contrast, the scam is aided and abetted by a regulatory environment whereby the threat of default is curtailed simply by raising the number of allowable paper promises (aka position limits) that can be issued by willing sellers. The COMEX allowable position limits in Gold and Silver are already completely out of whack, and when you add the “special limit exemptions” that have been extended to the “Big 8” bullion banks, the true scale of the fraud committed in the interest of preserving faith in paper money becomes clear. As these position limit exemptions have increased ever higher toward infinity, the legal ability to sell “Gold that grows on trees” has influenced bullion-bank traders to be more bold and more deeply entrenched in the fraud.

Where’s the Demand?

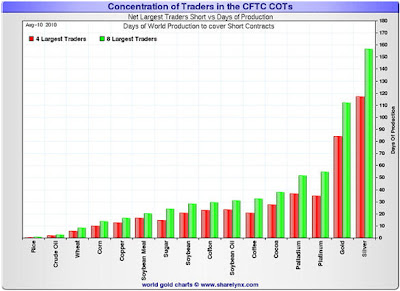

Just look at this comparison graph (above) showing the extent of forward selling (days of production) by the largest traders in various commodity markets to get a feel for the level of forward selling that gold and silver are subjected to by the big commercials, compared to other commodities. Why would world markets need so much forward sold silver and gold? Doesn’t everyone know that gold has very limited industrial use (especially compared to platinum or copper), and since photographic storage has moved from cellulose to silicon, industry’s chief consumption points for silver have also diminished drastically. And, if this much gold and silver really is changing hands out there, then why are eligible COMEX inventories sitting at 20 year lows? If the Big Commercial traders are laying on these enormous short positions as part of a legitimate hedging strategy, then why wouldn’t the same strategy work with crude oil? Or Wheat? And, most notably — why wouldn’t this same hedging strategy work with copper? Is it purely coincidence that there is so much concentration by a few mega-banks on the short side of the open interest in precisely the two elements that have served as the most viable forms of money for longer than any other medium in human history?

Okay, I’m drifting dangerously close to the “tin foil hat” event horizon. Let’s get back to Gomez and Nichols. These two chumps were eventually brought down by people who became impatient due to their expectation of physical delivery of the cars that they “purchased.” So too might the expectant recipients of physical bullion eventually reach the same level of impatience with those who are selling them paper promises to deliver real bullion (that is, unless they really, actually prefer owning even more potentially worthless paper contracts over physical metal).

Madoff’s Lesson

Bernie Madoff declared that he knew his empire was a Ponzi scheme for years before he got taken down, and he stated that once you realize it is fraud, your only choices left are to let it collapse immediately, or run the fraud as high (and as long) as you can. You become consumed by it. Is this what is happening today in the big silver and gold exchanges?

If you can logically conclude that there is no fraud in the COMEX gold and silver markets, then you can also conclude using the same logic that what Robert Gomez and James Nichols went to prison for was selling “futures contracts” against automobiles that they did not own, and had no intention of ever delivering. Is this any different from the forward-sold (i.e., short) positions in COMEX gold and silver? If Gomez and Nichols had successfully attempted to persuade the judge to allow them to simply increase the number of automobile delivery promises that they are entitled to issue, they might have been able to buy some cars in the “current month Craig’s List spot market” and made good on their earlier promises.. They would both still be free men, right?

Et tu, COMEX?

No comments:

Post a Comment