Well, it seems to be education week or month or something in Washington and on NBC coinciding w the release of the movie, Waiting for Superman. There is clearly something wrong w our public school system, which spends more money per student than any other country, but w poor results. I have seen and read parts of Obama's recent speech on the subject, and his words and actions seem somewhat contradictory. While I am not an expert, I have read a fair amount on the subject, and certain things seem glaringly clear.

1. The federal govt is more of a drag than a help. Govt makes most things worse, so why would we entrust the education of our children to the govt.

2. Throwing more money at the problem (the standard democratic answer) is not a good answer.

3. The teachers unions are a huge drag.

4. Greater parental involvement is a key, yet most of Obama's proposals seem to further limit the role of parents.

As a libertarian, I think the free market could do a lot better than the govt. Federal control and attempts to make all schoools and curriculum the same is wrong. Privatize education, let private companies compete to offer the best educational choices. The only way to find out what works is to try different things. Give tuition vouchers to poor children, or all children. (yea- I know that last one isn't very libertarian)

I predict future happiness for Americans if they can prevent the government from wasting the labors of the people under the pretense of taking care of them.- Thomas Jefferson.

debt clock

Tuesday, September 28, 2010

Monday, September 27, 2010

Rick’s Picks

Thursday, September 24, 2010

(There’s a good reason why bullion traders and investors have nicknamed the COMEX the CRIMEX. Read Robert Moore’s essay below to see why. Moore, a frequent contributor to the Rick’s Picks forum, says bullion bankers have leveraged the commodity exchange’s liberal rules to perpetrate a fraud that would land you or me in jail. RA)

In 2004, two young men named Robert “Buddha” Gomez and James Nichols fleeced thousands of people to the tune of $21 million by selling them “paper” automobiles. Here’s a link to more on this fascinating story by Car and Driver’s John Philips. These two hucksters swindled thousands of people into paying real money for nonexistent cars that were part of the fabricated estate of a fictitious, deceased eccentric millionaire, who declared in his will that these cars were only to be sold to “decent, churchgoing people” at unheard of bargain-basement prices as low as $1,000.

If Gomez and Nichols had known what was good for them, they would have studied the COMEX gold and silver futures market a little more closely before embarking on their little adventure into the exciting world of fraud. We all know that a futures contract is merely a paper promise to deliver a quantity of bullion (or some other commodity) for a pre-determined price at some future date. This is analogous to the paper promise to deliver “miracle cars” at some future estate settlement date; and as long as the promise to deliver can be sold to a willing buyer, then the scam can continue in perpetuity.

Gomez and Nichols’ scheme collapsed and they were both hung out to dry when the need to deliver real cars to settle these purchase agreements came due. In the gold and silver markets, by contrast, the scam is aided and abetted by a regulatory environment whereby the threat of default is curtailed simply by raising the number of allowable paper promises (aka position limits) that can be issued by willing sellers. The COMEX allowable position limits in Gold and Silver are already completely out of whack, and when you add the “special limit exemptions” that have been extended to the “Big 8” bullion banks, the true scale of the fraud committed in the interest of preserving faith in paper money becomes clear. As these position limit exemptions have increased ever higher toward infinity, the legal ability to sell “Gold that grows on trees” has influenced bullion-bank traders to be more bold and more deeply entrenched in the fraud.

Where’s the Demand?

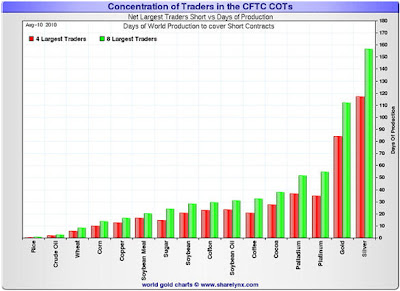

Just look at this comparison graph (above) showing the extent of forward selling (days of production) by the largest traders in various commodity markets to get a feel for the level of forward selling that gold and silver are subjected to by the big commercials, compared to other commodities. Why would world markets need so much forward sold silver and gold? Doesn’t everyone know that gold has very limited industrial use (especially compared to platinum or copper), and since photographic storage has moved from cellulose to silicon, industry’s chief consumption points for silver have also diminished drastically. And, if this much gold and silver really is changing hands out there, then why are eligible COMEX inventories sitting at 20 year lows? If the Big Commercial traders are laying on these enormous short positions as part of a legitimate hedging strategy, then why wouldn’t the same strategy work with crude oil? Or Wheat? And, most notably — why wouldn’t this same hedging strategy work with copper? Is it purely coincidence that there is so much concentration by a few mega-banks on the short side of the open interest in precisely the two elements that have served as the most viable forms of money for longer than any other medium in human history?

Okay, I’m drifting dangerously close to the “tin foil hat” event horizon. Let’s get back to Gomez and Nichols. These two chumps were eventually brought down by people who became impatient due to their expectation of physical delivery of the cars that they “purchased.” So too might the expectant recipients of physical bullion eventually reach the same level of impatience with those who are selling them paper promises to deliver real bullion (that is, unless they really, actually prefer owning even more potentially worthless paper contracts over physical metal).

Madoff’s Lesson

Bernie Madoff declared that he knew his empire was a Ponzi scheme for years before he got taken down, and he stated that once you realize it is fraud, your only choices left are to let it collapse immediately, or run the fraud as high (and as long) as you can. You become consumed by it. Is this what is happening today in the big silver and gold exchanges?

If you can logically conclude that there is no fraud in the COMEX gold and silver markets, then you can also conclude using the same logic that what Robert Gomez and James Nichols went to prison for was selling “futures contracts” against automobiles that they did not own, and had no intention of ever delivering. Is this any different from the forward-sold (i.e., short) positions in COMEX gold and silver? If Gomez and Nichols had successfully attempted to persuade the judge to allow them to simply increase the number of automobile delivery promises that they are entitled to issue, they might have been able to buy some cars in the “current month Craig’s List spot market” and made good on their earlier promises.. They would both still be free men, right?

Et tu, COMEX?

(There’s a good reason why bullion traders and investors have nicknamed the COMEX the CRIMEX. Read Robert Moore’s essay below to see why. Moore, a frequent contributor to the Rick’s Picks forum, says bullion bankers have leveraged the commodity exchange’s liberal rules to perpetrate a fraud that would land you or me in jail. RA)

In 2004, two young men named Robert “Buddha” Gomez and James Nichols fleeced thousands of people to the tune of $21 million by selling them “paper” automobiles. Here’s a link to more on this fascinating story by Car and Driver’s John Philips. These two hucksters swindled thousands of people into paying real money for nonexistent cars that were part of the fabricated estate of a fictitious, deceased eccentric millionaire, who declared in his will that these cars were only to be sold to “decent, churchgoing people” at unheard of bargain-basement prices as low as $1,000.

If Gomez and Nichols had known what was good for them, they would have studied the COMEX gold and silver futures market a little more closely before embarking on their little adventure into the exciting world of fraud. We all know that a futures contract is merely a paper promise to deliver a quantity of bullion (or some other commodity) for a pre-determined price at some future date. This is analogous to the paper promise to deliver “miracle cars” at some future estate settlement date; and as long as the promise to deliver can be sold to a willing buyer, then the scam can continue in perpetuity.

Gomez and Nichols’ scheme collapsed and they were both hung out to dry when the need to deliver real cars to settle these purchase agreements came due. In the gold and silver markets, by contrast, the scam is aided and abetted by a regulatory environment whereby the threat of default is curtailed simply by raising the number of allowable paper promises (aka position limits) that can be issued by willing sellers. The COMEX allowable position limits in Gold and Silver are already completely out of whack, and when you add the “special limit exemptions” that have been extended to the “Big 8” bullion banks, the true scale of the fraud committed in the interest of preserving faith in paper money becomes clear. As these position limit exemptions have increased ever higher toward infinity, the legal ability to sell “Gold that grows on trees” has influenced bullion-bank traders to be more bold and more deeply entrenched in the fraud.

Where’s the Demand?

Just look at this comparison graph (above) showing the extent of forward selling (days of production) by the largest traders in various commodity markets to get a feel for the level of forward selling that gold and silver are subjected to by the big commercials, compared to other commodities. Why would world markets need so much forward sold silver and gold? Doesn’t everyone know that gold has very limited industrial use (especially compared to platinum or copper), and since photographic storage has moved from cellulose to silicon, industry’s chief consumption points for silver have also diminished drastically. And, if this much gold and silver really is changing hands out there, then why are eligible COMEX inventories sitting at 20 year lows? If the Big Commercial traders are laying on these enormous short positions as part of a legitimate hedging strategy, then why wouldn’t the same strategy work with crude oil? Or Wheat? And, most notably — why wouldn’t this same hedging strategy work with copper? Is it purely coincidence that there is so much concentration by a few mega-banks on the short side of the open interest in precisely the two elements that have served as the most viable forms of money for longer than any other medium in human history?

Okay, I’m drifting dangerously close to the “tin foil hat” event horizon. Let’s get back to Gomez and Nichols. These two chumps were eventually brought down by people who became impatient due to their expectation of physical delivery of the cars that they “purchased.” So too might the expectant recipients of physical bullion eventually reach the same level of impatience with those who are selling them paper promises to deliver real bullion (that is, unless they really, actually prefer owning even more potentially worthless paper contracts over physical metal).

Madoff’s Lesson

Bernie Madoff declared that he knew his empire was a Ponzi scheme for years before he got taken down, and he stated that once you realize it is fraud, your only choices left are to let it collapse immediately, or run the fraud as high (and as long) as you can. You become consumed by it. Is this what is happening today in the big silver and gold exchanges?

If you can logically conclude that there is no fraud in the COMEX gold and silver markets, then you can also conclude using the same logic that what Robert Gomez and James Nichols went to prison for was selling “futures contracts” against automobiles that they did not own, and had no intention of ever delivering. Is this any different from the forward-sold (i.e., short) positions in COMEX gold and silver? If Gomez and Nichols had successfully attempted to persuade the judge to allow them to simply increase the number of automobile delivery promises that they are entitled to issue, they might have been able to buy some cars in the “current month Craig’s List spot market” and made good on their earlier promises.. They would both still be free men, right?

Et tu, COMEX?

from brainrules.blogspot.com/

A good example is driving while talking on a cell phone. Until researchers started measuring the effects of cell-phone distractions under controlled conditions, nobody had any idea how profoundly they can impair a driver. It’s like driving drunk. Recall that large fractions of a second are consumed every time the brain switches tasks. Cell-phone talkers are a half-second slower to hit the brakes in emergencies, slower to return to normal speed after an emergency, and more wild in their “following distance” behind the vehicle in front of them. In a half-second, a driver going 70 mph travels 51 feet. Given that 80 percent of crashes happen within three seconds of some kind of driver distraction, increasing your amount of task-switching increases your risk of an accident. More than 50 percent of the visual cues spotted by attentive drivers are missed by cell-phone talkers. Not surprisingly, they get in more wrecks than anyone except very drunk drivers.

http://brainrules.blogspot.com/search?q=driving

http://brainrules.blogspot.com/search?q=driving

CIA, CFR, Bilderberg Ties To The Ground Zero Mosque

September 20, 2010 by Bob Livingston

It has become patently obvious the Ground Zero Cordoba House mosque is a CIA-backed, One World Government-inspired plot designed to jinn up Americans’ anger at Muslims and increase support for the global war on terror.

Reporting for The New York Observer, Mark Ames tied together the links between the mosque, the CIA and the U.S. military establishment.

One of the mosque’s main financial backers is 52-year-old New Yorker R. Leslie Deak. Deak donated $98,000 to the nonprofit Cordoba Initiative between 2006 and 2008. Deak is a “business consultant” for Patriot Defense Group, LLC, a private defense contractor for the CIA and U.S. military. The secretive organization doesn’t even list the names of its management team but describes them as former Special Forces, former CIA, former State Department and former Secret Service.

The Observer also notes Deak’s strong ties to Mark Treanor, the former general counsel for Wachovia Bank which was fined $160 million for laundering Mexican drug money while Treanor was there.

Additionally, Deak’s father Nicholas was a former top intelligence commander for the OSS (the forerunner of the CIA) and his company, Deak-Perera — which at one time was one of the world’s largest foreign currency and gold dealers — was accused in 1984 of laundering Columbian drug cartel money. The elder Deak was murdered at the company headquarters in 1985.

The article also ties together the links between Leslie Deak and Goldline International, the company that sponsors Glenn Beck’s radio show, his FoxNews television show and some other neo-conservative, pro-war pundits. Of course, FoxNews is partially owned by Saudi Arabian Prince Al-Waleed bin Talal, who also funds projects for the mosque’s front man, Imam Rauf.

Deak’s Deak Family Foundation is also a supporter of the American Society for Muslim Advancement (ASMA), of which Rauf is a part. The ASMA is financially supported by, among others, the Carnegie Corporation of New York, Rockefeller Brothers, Rockefeller Philanthropy and Rockefeller Brothers Fund.

Rauf, has worked as an FBI “consultant” and was recruited by former President George W. Bush advisor and confidant Karen Hughes to lead the administration’s Middle East propaganda efforts. Rauf is also an active member of the Council on Foreign Relations.

All this ties the whole operation to the CIA, the CFR, the Bilderberg Group and the military-industrial complex.

The CIA and the military-industrial complex stand to gain billions of dollars from a continuation of the global war on terror which gains support from this manufactured controversy. Meanwhile the CFR and the Bilderbergers and their global elite friends have a powerful issue that takes momentum away from the rising tide of patriotism and political awakening of the masses that’s been harming their globalist agenda.

It has become patently obvious the Ground Zero Cordoba House mosque is a CIA-backed, One World Government-inspired plot designed to jinn up Americans’ anger at Muslims and increase support for the global war on terror.

Reporting for The New York Observer, Mark Ames tied together the links between the mosque, the CIA and the U.S. military establishment.

One of the mosque’s main financial backers is 52-year-old New Yorker R. Leslie Deak. Deak donated $98,000 to the nonprofit Cordoba Initiative between 2006 and 2008. Deak is a “business consultant” for Patriot Defense Group, LLC, a private defense contractor for the CIA and U.S. military. The secretive organization doesn’t even list the names of its management team but describes them as former Special Forces, former CIA, former State Department and former Secret Service.

The Observer also notes Deak’s strong ties to Mark Treanor, the former general counsel for Wachovia Bank which was fined $160 million for laundering Mexican drug money while Treanor was there.

Additionally, Deak’s father Nicholas was a former top intelligence commander for the OSS (the forerunner of the CIA) and his company, Deak-Perera — which at one time was one of the world’s largest foreign currency and gold dealers — was accused in 1984 of laundering Columbian drug cartel money. The elder Deak was murdered at the company headquarters in 1985.

The article also ties together the links between Leslie Deak and Goldline International, the company that sponsors Glenn Beck’s radio show, his FoxNews television show and some other neo-conservative, pro-war pundits. Of course, FoxNews is partially owned by Saudi Arabian Prince Al-Waleed bin Talal, who also funds projects for the mosque’s front man, Imam Rauf.

Deak’s Deak Family Foundation is also a supporter of the American Society for Muslim Advancement (ASMA), of which Rauf is a part. The ASMA is financially supported by, among others, the Carnegie Corporation of New York, Rockefeller Brothers, Rockefeller Philanthropy and Rockefeller Brothers Fund.

Rauf, has worked as an FBI “consultant” and was recruited by former President George W. Bush advisor and confidant Karen Hughes to lead the administration’s Middle East propaganda efforts. Rauf is also an active member of the Council on Foreign Relations.

All this ties the whole operation to the CIA, the CFR, the Bilderberg Group and the military-industrial complex.

The CIA and the military-industrial complex stand to gain billions of dollars from a continuation of the global war on terror which gains support from this manufactured controversy. Meanwhile the CFR and the Bilderbergers and their global elite friends have a powerful issue that takes momentum away from the rising tide of patriotism and political awakening of the masses that’s been harming their globalist agenda.

Friday, September 24, 2010

Investors Are Deaf to the Screams of Gold, Cotton: Mark Gilbert

By Mark Gilbert - Sep 22, 2010 6:00 PM CT Email Share

Most of us own truths too painful to confess. We drink too much. We lust inappropriately. We envy. We covet material goods, when every study shows experiences count for so much more. Confessing them, even just to ourselves in the long, dark teatime of the soul, is too distressing.

The collective subconscious of the financial markets is no different. It knows pension systems are bankrupt, water wars are coming, China will best the West, Keynesian stimulus is a surefire way to stoke inflation, gold is saying something, and the banking community remains as rapacious as it was prior to the credit crisis. Knowing and admitting isn’t the same thing.

The following paragraphs list some of the taboos that should ping our radar harder.

In Price Is Knowledge

If you told Rip van Bondtrader that gold had risen to a record during his decade-long slumber, he’d want to know what the inflation outlook was, and how badly he’d gotten killed on his bond investments. He’d be astonished to discover that he’s made a total return of about 8 percent since January on Treasuries maturing in more than a year.

“What makes the gold story so interesting is that bullion has so many different correlations -- with inflation, with the dollar, with interest rates, with political uncertainty,” according to David Rosenberg, chief economist at Gluskin Sheff & Associates in Toronto. “This year, for example, gold has shifted from being a commodity toward being a currency -- the classic role as a monetary metal that is no government’s liability.”

Gold may be screaming more about a general mistrust of the securities markets than about the prospect of rising prices. Rip, though, would be similarly horrified to see cotton trading near a 15-year high at more than $1 a pound, or wheat surging more than 30 percent in the past year, helping to drive a UBS/Bloomberg index of food prices up by about 28 percent. The official figures say inflation is dormant; the phrase “lies, damned lies and statistics” springs to mind.

Lots of Clever People Don’t Believe in Currencies

Imagine trying to explain to a grandmother or a teenager that a lot of very clever people in the financial world don’t actually believe in dollars, euros and yen. Exchanging goods and services for bits of paper is a confidence game, say some; a conjuring trick without bones, because without the skeleton of a gold standard, so-called fiat currencies are worth nothing more than the paper they are printed on.

Even the majority of finance professionals who don’t see any need to back currencies with precious metals are haunted by the thought of the central bank printing presses whirring into action. And, with every nation in the world trying to export its way out of trouble, the beggar-thy-neighbor race to devalue currencies will only gather pace in the coming months.

When I’m 64

Folk wisdom claims that bumble bees defy the laws of physics because their power-to-weight ratio should be insufficient to allow flight. Luckily, because the bees don’t know this, they happily take off, buzz around and land, buoyed by blissful ignorance. Similarly, no sane investor would ever buy a stock or a bond if they stopped to consider the inverted- pyramid mathematics of an ageing, death-resistant population, a slump in birthrates, and the New Normal of spectacularly low returns in a post-bubble environment.

How on Earth is society going to pay pensions to this growing army of old people? If granddad does what investment theory says he should and socks his nest egg (assuming he even has one) into the ultra safety of Treasuries, earning a record- low yield of less than 0.45 percent on two-year securities, how will he afford his medications? Many countries and companies are probably bankrupt once you account properly for their future obligations; some problems, though, are too big and too intractable and too downright scary for polite conversation.

Water, Water Everywhere

The recent surge in the price of wheat as a summer-singed Russia banned exports should have been a sign that food security is a global tinderbox waiting to flare. Everyone has read the stories about Chinese officials wandering around Africa buying agricultural rights that last for decades; no-one wants to really consider the consequences of not being able to feed their kids.

While the West was tinkering with its crops to grow allegedly environmentally friendly fuel for our automobile obsession, the nation that takes the long view was snapping up long-term leases on the world’s bread boxes. In the not-too distant future, nations that currently share rivers will divide into those geographically fortunate enough to be the source of those waterways, and those risking drought and deprivation.

The Inflationary Consequences of John Maynard Keynes

Inflation is always and everywhere a monetary phenomenon, according to Milton Friedman, who has been eclipsed in recent years by his chief competitor, John Maynard Keynes. Every bond investor suspects that chucking billions of dollars into the global economy builds a bed of kindling; nobody wants to shout “fire!” in a crowded trade.

The Answer to Too Much Debt Is Not More Debt

Lending to governments is not risk-free, whether that government is Argentina, Iceland, Ireland or the U.S. These days, when you buy government debt, you are taking on the credit risk of the global financial system because that is what the too-big-to-fail doctrine has saddled the world’s taxpayers with.

This week’s successful debt auctions by Ireland, Greece and Spain sure beat the alternative of failed sales with nobody turning up. With central banks acting as buyers of first and last resort, however, it is impossible to pretend that the capital markets are functioning properly -- another dirty little secret kept suppressed deep in the subconscious.

(Mark Gilbert is the London bureau chief and a columnist for Bloomberg News. The opinions expressed are his own.)

Most of us own truths too painful to confess. We drink too much. We lust inappropriately. We envy. We covet material goods, when every study shows experiences count for so much more. Confessing them, even just to ourselves in the long, dark teatime of the soul, is too distressing.

The collective subconscious of the financial markets is no different. It knows pension systems are bankrupt, water wars are coming, China will best the West, Keynesian stimulus is a surefire way to stoke inflation, gold is saying something, and the banking community remains as rapacious as it was prior to the credit crisis. Knowing and admitting isn’t the same thing.

The following paragraphs list some of the taboos that should ping our radar harder.

In Price Is Knowledge

If you told Rip van Bondtrader that gold had risen to a record during his decade-long slumber, he’d want to know what the inflation outlook was, and how badly he’d gotten killed on his bond investments. He’d be astonished to discover that he’s made a total return of about 8 percent since January on Treasuries maturing in more than a year.

“What makes the gold story so interesting is that bullion has so many different correlations -- with inflation, with the dollar, with interest rates, with political uncertainty,” according to David Rosenberg, chief economist at Gluskin Sheff & Associates in Toronto. “This year, for example, gold has shifted from being a commodity toward being a currency -- the classic role as a monetary metal that is no government’s liability.”

Gold may be screaming more about a general mistrust of the securities markets than about the prospect of rising prices. Rip, though, would be similarly horrified to see cotton trading near a 15-year high at more than $1 a pound, or wheat surging more than 30 percent in the past year, helping to drive a UBS/Bloomberg index of food prices up by about 28 percent. The official figures say inflation is dormant; the phrase “lies, damned lies and statistics” springs to mind.

Lots of Clever People Don’t Believe in Currencies

Imagine trying to explain to a grandmother or a teenager that a lot of very clever people in the financial world don’t actually believe in dollars, euros and yen. Exchanging goods and services for bits of paper is a confidence game, say some; a conjuring trick without bones, because without the skeleton of a gold standard, so-called fiat currencies are worth nothing more than the paper they are printed on.

Even the majority of finance professionals who don’t see any need to back currencies with precious metals are haunted by the thought of the central bank printing presses whirring into action. And, with every nation in the world trying to export its way out of trouble, the beggar-thy-neighbor race to devalue currencies will only gather pace in the coming months.

When I’m 64

Folk wisdom claims that bumble bees defy the laws of physics because their power-to-weight ratio should be insufficient to allow flight. Luckily, because the bees don’t know this, they happily take off, buzz around and land, buoyed by blissful ignorance. Similarly, no sane investor would ever buy a stock or a bond if they stopped to consider the inverted- pyramid mathematics of an ageing, death-resistant population, a slump in birthrates, and the New Normal of spectacularly low returns in a post-bubble environment.

How on Earth is society going to pay pensions to this growing army of old people? If granddad does what investment theory says he should and socks his nest egg (assuming he even has one) into the ultra safety of Treasuries, earning a record- low yield of less than 0.45 percent on two-year securities, how will he afford his medications? Many countries and companies are probably bankrupt once you account properly for their future obligations; some problems, though, are too big and too intractable and too downright scary for polite conversation.

Water, Water Everywhere

The recent surge in the price of wheat as a summer-singed Russia banned exports should have been a sign that food security is a global tinderbox waiting to flare. Everyone has read the stories about Chinese officials wandering around Africa buying agricultural rights that last for decades; no-one wants to really consider the consequences of not being able to feed their kids.

While the West was tinkering with its crops to grow allegedly environmentally friendly fuel for our automobile obsession, the nation that takes the long view was snapping up long-term leases on the world’s bread boxes. In the not-too distant future, nations that currently share rivers will divide into those geographically fortunate enough to be the source of those waterways, and those risking drought and deprivation.

The Inflationary Consequences of John Maynard Keynes

Inflation is always and everywhere a monetary phenomenon, according to Milton Friedman, who has been eclipsed in recent years by his chief competitor, John Maynard Keynes. Every bond investor suspects that chucking billions of dollars into the global economy builds a bed of kindling; nobody wants to shout “fire!” in a crowded trade.

The Answer to Too Much Debt Is Not More Debt

Lending to governments is not risk-free, whether that government is Argentina, Iceland, Ireland or the U.S. These days, when you buy government debt, you are taking on the credit risk of the global financial system because that is what the too-big-to-fail doctrine has saddled the world’s taxpayers with.

This week’s successful debt auctions by Ireland, Greece and Spain sure beat the alternative of failed sales with nobody turning up. With central banks acting as buyers of first and last resort, however, it is impossible to pretend that the capital markets are functioning properly -- another dirty little secret kept suppressed deep in the subconscious.

(Mark Gilbert is the London bureau chief and a columnist for Bloomberg News. The opinions expressed are his own.)

Thursday, September 23, 2010

Libertarians fight to break cycle of battered gay voter syndrome

WASHINGTON - Like abused spouses who keep returning to their aggressors, gay voters keep handing their votes to the Democrats who abuse them.

The Libertarian Party (LP) wants to break this self-destructive behavior and offers LGBT voters a better alternative.

LP Chairman Mark Hinkle said, "Exit polls indicate that Democrats get over 70% of LGBT votes in federal elections. Those voters must really love the Democrats' rhetoric, because they certainly aren't seeing any action.

"President Obama and the Democrats had almost a year of complete control of the federal government: the Presidency, the House, and a filibuster-proof 60 votes in the Senate. They could have repealed 'don't ask don't tell.' They could have gotten rid of the Defense of Marriage Act. But they didn't do either of those things. That's a complete and total betrayal of all the promises they made to gay and lesbian voters for years.

"After a carefully orchestrated failure in the Senate, the Democrats are now blaming Republicans for blocking the repeal of 'don't ask don't tell.' Of course, three Democrats just voted against it too, including Majority Leader Harry Reid. Reid claims he voted for procedural reasons, but the whole situation seems calculated to look like they're trying to help, while making sure they don't actually help."

Unlike the Democratic and Republican Parties, the Libertarian Party believes that gays and lesbians deserve equal treatment under the law.

LP Executive Director Wes Benedict added, "The Libertarian Party neither supports nor opposes gay relationships. Libertarians are black, white, young, old, straight, gay, Christian, atheist, yuppie, hippie, rich, poor, greedy, generous, eccentric and just plain average. Though their backgrounds and lifestyles are diverse, they are united on the principle of minimum government and maximum freedom."

The LP Platform states:

"1.3 Personal Relationships

Sexual orientation, preference, gender, or gender identity should have no impact on the government's treatment of individuals, such as in current marriage, child custody, adoption, immigration or military service laws. Government does not have the authority to define, license or restrict personal relationships. Consenting adults should be free to choose their own sexual practices and personal relationships."

The Libertarian Party has 21 candidates for U.S. Senate and 170 candidates for U.S. House in the upcoming November 2010 elections.

For more information, or to arrange an interview, call LP Executive Director Wes Benedict at 202-333-0008 ext. 222.

The LP is America's third-largest political party, founded in 1971. The Libertarian Party stands for free markets and civil liberties. You can find more information on the Libertarian Party at our website.

The Libertarian Party (LP) wants to break this self-destructive behavior and offers LGBT voters a better alternative.

LP Chairman Mark Hinkle said, "Exit polls indicate that Democrats get over 70% of LGBT votes in federal elections. Those voters must really love the Democrats' rhetoric, because they certainly aren't seeing any action.

"President Obama and the Democrats had almost a year of complete control of the federal government: the Presidency, the House, and a filibuster-proof 60 votes in the Senate. They could have repealed 'don't ask don't tell.' They could have gotten rid of the Defense of Marriage Act. But they didn't do either of those things. That's a complete and total betrayal of all the promises they made to gay and lesbian voters for years.

"After a carefully orchestrated failure in the Senate, the Democrats are now blaming Republicans for blocking the repeal of 'don't ask don't tell.' Of course, three Democrats just voted against it too, including Majority Leader Harry Reid. Reid claims he voted for procedural reasons, but the whole situation seems calculated to look like they're trying to help, while making sure they don't actually help."

Unlike the Democratic and Republican Parties, the Libertarian Party believes that gays and lesbians deserve equal treatment under the law.

LP Executive Director Wes Benedict added, "The Libertarian Party neither supports nor opposes gay relationships. Libertarians are black, white, young, old, straight, gay, Christian, atheist, yuppie, hippie, rich, poor, greedy, generous, eccentric and just plain average. Though their backgrounds and lifestyles are diverse, they are united on the principle of minimum government and maximum freedom."

The LP Platform states:

"1.3 Personal Relationships

Sexual orientation, preference, gender, or gender identity should have no impact on the government's treatment of individuals, such as in current marriage, child custody, adoption, immigration or military service laws. Government does not have the authority to define, license or restrict personal relationships. Consenting adults should be free to choose their own sexual practices and personal relationships."

The Libertarian Party has 21 candidates for U.S. Senate and 170 candidates for U.S. House in the upcoming November 2010 elections.

For more information, or to arrange an interview, call LP Executive Director Wes Benedict at 202-333-0008 ext. 222.

The LP is America's third-largest political party, founded in 1971. The Libertarian Party stands for free markets and civil liberties. You can find more information on the Libertarian Party at our website.

Monday, September 20, 2010

Congressmen Weiner and Waxman Set Gold Hearing

http://seekingalpha.com/article/225579-congressmen-weiner-and-waxman-set-gold-hearing

Just as the government is trying to prevent people from investing in anything other than T-Bills by raising taxes on taxable interest and dividends to confiscatory levels, it's also trying to prevent you from parking your wealth in assets, like gold, that compete with the paper dollars issued by the Federal Reserve and the Treasury. A press release from Rep. Anthony Weiner, Democrat of New York, not yet (as of this instant) posted on Mr. Weiner's Web site, announces that a September 23 hearing of the Subcommittee on Commerce, Trade, and Consumer Protection (a subcommittee of Rep. Henry Waxman's Commerce Committee) will focus on "legislation that would regulate gold-selling companies, an industry who's [sic] relentless advertising is now staple of cable television."

From the press release: "Under Rep. Weiner's bill, companies like Goldline would be required to disclose the reasonable resale value of items being sold." That's great. Are Mr. Weiner and Chairman Bernanke also going to agree to print on every dollar the reasonable expectation that its value will be eroded by inflation?

Gold investors (or speculators) are already punished by the federal government by having their investment, even in a gold exchange-traded-fund, taxed at the higher rates that apply to collectibles rather than long term capital gains.

Not to mention the fact that Mr. Weiner's regulatory push seems as much aimed at conservative journalists as at the gold-dealers. The press release says, "Goldline employs several conservative pundits to act as shills for its' [sic] precious metal business, including Glenn Beck, Mike Huckabee, Laura Ingraham, and Fred Thompson. By drumming up public fears during financially uncertain times, conservative pundits are able to drive a false narrative. Glenn Beck for example has dedicated entire segments of his program to explaining why the U.S. money supply is destined for hyperinflation with Barack Obama as president."

Imagine the uproar if a Republican-majority Congress started investigating and having a regulatory crackdown on big advertisers in liberal outlets such as the New York Times. The First Amendment freedom-of-the-press crowd would be marching in the streets.

The whole situation is amazing. If Mr. Weiner really wants to calm fears about hyperinflation, the last way to do it is to have a government hearing cracking down on the people warning of it.

The press release reports that "invitations to the hearing have been sent to the representatives of Goldline International, the Federal Trade Commission, the Consumers Union and other potential witnesses, including former Goldline employees." Mr. Weiner might also consider calling John Paulson and George Soros, who have also reportedly been buying gold lately, though Mr. Soros was also quoted as calling it a bubble. But Mr. Paulson saw the housing bubble coming so he might be right about the inflation risks, and Mr. Soros is a big funder of left-wing causes, so neither of them would fit with the objective of the hearing.

Anyway, we are looking forward to the hearing, which should be quite a show.

Just as the government is trying to prevent people from investing in anything other than T-Bills by raising taxes on taxable interest and dividends to confiscatory levels, it's also trying to prevent you from parking your wealth in assets, like gold, that compete with the paper dollars issued by the Federal Reserve and the Treasury. A press release from Rep. Anthony Weiner, Democrat of New York, not yet (as of this instant) posted on Mr. Weiner's Web site, announces that a September 23 hearing of the Subcommittee on Commerce, Trade, and Consumer Protection (a subcommittee of Rep. Henry Waxman's Commerce Committee) will focus on "legislation that would regulate gold-selling companies, an industry who's [sic] relentless advertising is now staple of cable television."

From the press release: "Under Rep. Weiner's bill, companies like Goldline would be required to disclose the reasonable resale value of items being sold." That's great. Are Mr. Weiner and Chairman Bernanke also going to agree to print on every dollar the reasonable expectation that its value will be eroded by inflation?

Gold investors (or speculators) are already punished by the federal government by having their investment, even in a gold exchange-traded-fund, taxed at the higher rates that apply to collectibles rather than long term capital gains.

Not to mention the fact that Mr. Weiner's regulatory push seems as much aimed at conservative journalists as at the gold-dealers. The press release says, "Goldline employs several conservative pundits to act as shills for its' [sic] precious metal business, including Glenn Beck, Mike Huckabee, Laura Ingraham, and Fred Thompson. By drumming up public fears during financially uncertain times, conservative pundits are able to drive a false narrative. Glenn Beck for example has dedicated entire segments of his program to explaining why the U.S. money supply is destined for hyperinflation with Barack Obama as president."

Imagine the uproar if a Republican-majority Congress started investigating and having a regulatory crackdown on big advertisers in liberal outlets such as the New York Times. The First Amendment freedom-of-the-press crowd would be marching in the streets.

The whole situation is amazing. If Mr. Weiner really wants to calm fears about hyperinflation, the last way to do it is to have a government hearing cracking down on the people warning of it.

The press release reports that "invitations to the hearing have been sent to the representatives of Goldline International, the Federal Trade Commission, the Consumers Union and other potential witnesses, including former Goldline employees." Mr. Weiner might also consider calling John Paulson and George Soros, who have also reportedly been buying gold lately, though Mr. Soros was also quoted as calling it a bubble. But Mr. Paulson saw the housing bubble coming so he might be right about the inflation risks, and Mr. Soros is a big funder of left-wing causes, so neither of them would fit with the objective of the hearing.

Anyway, we are looking forward to the hearing, which should be quite a show.

Signs Of A Crumbling Regime

September 20, 2010 by Bob Livingston

Can you see it? The signs are everywhere. The regime is crumbling.

No not the President Barack Obama regime, though that is part of it; maybe even the catalyst in the United States, at least. I’m talking about the regime in general; the system.

You can see it in places like Greece. There the government has been fighting for its economic life. Years of socialist redistribution — theft from the producers to finance the growing State leviathan and unionized public and private sector employees — have caught up.

The government is now instituting “austerity” measures. It has to. It can’t meet its obligations. So it’s cutting back on growth in salaries, vacation days, benefits and pensions. Unionized public works employees and service employees aren’t happy their gravy train has jumped the tracks. They strike and riot. Greece may or may not survive.

Much the same is going on in other parts of Europe. The French government’s plans to save money by raising the retirement age to 62 from 60 sparked a one-day strike among workers from the public and private sectors in transportation, education, justice, healthcare, media and banking.

The “little people” are waking up to the fact that their governments — the elected class — have done them a disservice. Their regimes, financed by fiat money and having positioned themselves as the “Great Nannies,” are unable to fulfill promises of utopia, wine and roses.

Instead, the elected class enrich themselves. They finance wars through fiat, sending the masses in as fodder while the military-industrial complex grows stronger and pushes for more wars and more fiat money.

Here in America there have yet to be massive strikes and riots, though there are plenty of disaffected people with time on their hands to conduct such shenanigans. According to the U.S. Department of Labor there are 14.9 million unemployed. There are actually more. The government cooks its books. It doesn’t count those no longer seeking work.

Obama blew into office in January 2009 with stratospheric approval numbers. His “Hope and Change” mantra convinced many that “free stuff” was coming their way. In several videos posted on YouTube before Obama’s inauguration some of his voters say money from Obama’s “stash” will come to them or that they will no longer have to pay their mortgage or for gas. Apparently they really believed they no longer were obligated to pay their debts just because the Marxist was elected.

Obama and his Corporatist Democrat cohorts proceeded to pass more stimulus bills and focused on ramming Obamacare down the throats of the American people. The American people wanted the regime to focus on job creation rather than bailouts and Obamacare. The “free stuff” never came. Those waiting on it apparently don’t understand that governments don’t give… governments only consume: one way or the other.

The bailouts enriched the banksters and Wall Street, and Obamacare — a Eurosocialist healthcare model — was implemented to steal freedom from of choice from Americans and saddle them with coming additional taxes and death panels that will decide whether they live or die. What’s more, to comply with the coming mandates to insure the previously uninsurable and everyone else, insurance companies are raising rates faster than they did before healthcare became “free for all.”

But the regime doesn’t like any kind of dissent. So it threatens, through a letter from Health and Human Services Secretary Kathleen Sebelius, to put health insurers out of business if they don’t quit “using scare tactics and misinformation to falsely blame premium increases for 2011 on the patient protections in the Affordable Care Act.”

Sebelius says her experts and academic advisors believe any increased costs to insurance companies will be minimal. Government experts and academics operate in the fantasy land of theory. Businesses operate in the realm of reality. Businesses understand that regulations and mandates cost them money.

It’s not the first time the regime has threatened businesses. When AT&T, Caterpillar and others explained to shareholders what the new healthcare law would cost, the thug Congressman Henry Waxman (D-Calif.) demanded proof and threatened to bring them before Congress. Waxman backed down when the companies provided proof.

You may recall that Obama’s thugocratic regime also threatened those holding the debt of General Motors and Chrysler during bankruptcy negotiations. “Agree to our settlement or risk getting nothing,” was the message. “Two hundred years of case law on bankruptcy be damned,” the thugocracy said.

The result of all this is approval ratings in the low 40s for Obama and single digits for Congress. The elites first caught wind of voter dissatisfaction during Town Hall meetings. No longer were they pleasant affairs attended by a few old codgers looking for a free cup of coffee. Now voters were expressing their discontent. The elites got scared and ducked and ran or hired thugs to protect them from their “malcontent” constituents. They grabbed video cameras or ordered them turned off. These embarrassing moments appeared on YouTube for any who were interested to see.

When special elections were held, incumbents and establishment candidates got trounced. Tea Parties grew stronger, their message resonated and spread. The large rallies in Washington, D.C., and around the nation frightened the regime.

The regime has responded. With corporate mainstream media’s audience falling precipitously the regime realized it was losing the message. People no longer turned to the alphabet soup news gatherers and the “All the news that’s fit to print” newspapers that all spread the same government propaganda. They sought their news from other sources: talk radio, the Internet.

So now the regime is pushing a bill to turn off the Internet. It also seeks a “fairness doctrine” so it can control radio content. Moves such as these will draw out the masses. If that happens the results won’t be pretty.

The Republican establishment is not immune from the public’s ire. In fact, the Republican Party is in the crosshairs of the Tea Party. Tea Party candidates are taking out the traditional “chosen” Republicans and reshaping the GOP in their image. The regime is surprised.

It shouldn’t be. The Republican establishment backs liberals like Mike Castle — a pro-abortion, pro-gun control, tax and spend liberal who calls himself a Republican — who as a Congressman sided with the Democrats more than Republicans. Tea Party conservatives figured it’s better to back a conservative with a chance she might lose in November than support a liberal Republican who votes for Democrat policies they’ve rejected.

So Christine O’Donnell whipped Castle for the Republican Senate nomination in Delaware. The Republican regime went into a snit, called O’Donnell names and cast doubts about her electability.

Karl Rove, the former advisor to President George W. Bush and architect of many of the Republican failures during the Bush years that resulted in the ascendancy of the current Democrat and Obama regime, was the poster child of regime arrogance on election night. He called O’Donnell nutty, and added other less-than-flattering adjectives. The National Republican Senate Committee said it would not be supporting her candidacy. What arrogance!

No matter. Tea Partiers responded. On Wednesday after her nomination, O’Donnell saw donations pour in from across the country. Her website crashed from the traffic.

Sensing trouble, the NRSC relented and quickly cut a check to her campaign.

The Republican establishment is slow to learn. The regime has a history of backing the wrong candidate: Charlie Crist over Marco Rubio, Senator Lisa Murkowski over Joe Miller, Trey Grayson over Rand Paul, Senator Bob Bennett (R-Utah) over Mike Lee, Rick Lazio over Carl Paladino. The regime doesn’t have it figured out yet.

“Establishment Republicans have no idea how livid Americans are with them,” Richard A. Viguerie told The Washington Examiner last Wednesday. “Republican leaders are in a panic because they have lost control of the Republican Party. Grassroots constitutional conservatives are inside the Citadel, and are poised to take over.”

The public is fed up. Democrats don’t yet realize it, but as soon as the Tea Party finishes cleaning up the parts of the Republican Party they can get to this election cycle, the Democrat purge will begin in earnest. That cleaning starts on Nov. 2. It won’t end there, regardless of the outcome. There will still be a lot of trash in Washington — Republican and Democrat — on the day after the first Tuesday after the first Monday in November. But Americans are as energized over the idea of a cleansing as they have ever been.

Democrats and Republicans alike face a tsunami in November the likes of which they still can’t imagine. Americans are ready to throw off the yoke of slavery they have toiled under for many years. The straws of control, taxes, government spending and regulations have finally broken the camel’s back.

The fascist regime is no longer stable. It knows only control, wars and more spending. So it continues to grow deficits, conduct wars without end, rattle sabers for more wars, put more regulations on food, push more “approved” harmful drugs on consumers, order more vaccinations, restrict access to natural health supplements and exercise more control over the public.

The regime calls for tax increases. This, too, is an effort at more control. It is legalized theft of your production.

Gold hit a record high last week. It is evidence the public is aware the regime is crumbling. The fiat system, instituted under the darkness of night 97 years ago, is failing. Throwing more fiat at the debt and deficits have succeeded only in creating more debt and greater deficits. The calculator the regime uses only adds and multiplies. The subtraction key doesn’t work. History shows this is a recipe for failure.

Store food for food and food for barter. Store water for sustenance. Store guns and ammunition for protection. Store gold and silver for wealth preservation. Prepare; for the regime is crumbling.

Can you see it? The signs are everywhere. The regime is crumbling.

No not the President Barack Obama regime, though that is part of it; maybe even the catalyst in the United States, at least. I’m talking about the regime in general; the system.

You can see it in places like Greece. There the government has been fighting for its economic life. Years of socialist redistribution — theft from the producers to finance the growing State leviathan and unionized public and private sector employees — have caught up.

The government is now instituting “austerity” measures. It has to. It can’t meet its obligations. So it’s cutting back on growth in salaries, vacation days, benefits and pensions. Unionized public works employees and service employees aren’t happy their gravy train has jumped the tracks. They strike and riot. Greece may or may not survive.

Much the same is going on in other parts of Europe. The French government’s plans to save money by raising the retirement age to 62 from 60 sparked a one-day strike among workers from the public and private sectors in transportation, education, justice, healthcare, media and banking.

The “little people” are waking up to the fact that their governments — the elected class — have done them a disservice. Their regimes, financed by fiat money and having positioned themselves as the “Great Nannies,” are unable to fulfill promises of utopia, wine and roses.

Instead, the elected class enrich themselves. They finance wars through fiat, sending the masses in as fodder while the military-industrial complex grows stronger and pushes for more wars and more fiat money.

Here in America there have yet to be massive strikes and riots, though there are plenty of disaffected people with time on their hands to conduct such shenanigans. According to the U.S. Department of Labor there are 14.9 million unemployed. There are actually more. The government cooks its books. It doesn’t count those no longer seeking work.

Obama blew into office in January 2009 with stratospheric approval numbers. His “Hope and Change” mantra convinced many that “free stuff” was coming their way. In several videos posted on YouTube before Obama’s inauguration some of his voters say money from Obama’s “stash” will come to them or that they will no longer have to pay their mortgage or for gas. Apparently they really believed they no longer were obligated to pay their debts just because the Marxist was elected.

Obama and his Corporatist Democrat cohorts proceeded to pass more stimulus bills and focused on ramming Obamacare down the throats of the American people. The American people wanted the regime to focus on job creation rather than bailouts and Obamacare. The “free stuff” never came. Those waiting on it apparently don’t understand that governments don’t give… governments only consume: one way or the other.

The bailouts enriched the banksters and Wall Street, and Obamacare — a Eurosocialist healthcare model — was implemented to steal freedom from of choice from Americans and saddle them with coming additional taxes and death panels that will decide whether they live or die. What’s more, to comply with the coming mandates to insure the previously uninsurable and everyone else, insurance companies are raising rates faster than they did before healthcare became “free for all.”

But the regime doesn’t like any kind of dissent. So it threatens, through a letter from Health and Human Services Secretary Kathleen Sebelius, to put health insurers out of business if they don’t quit “using scare tactics and misinformation to falsely blame premium increases for 2011 on the patient protections in the Affordable Care Act.”

Sebelius says her experts and academic advisors believe any increased costs to insurance companies will be minimal. Government experts and academics operate in the fantasy land of theory. Businesses operate in the realm of reality. Businesses understand that regulations and mandates cost them money.

It’s not the first time the regime has threatened businesses. When AT&T, Caterpillar and others explained to shareholders what the new healthcare law would cost, the thug Congressman Henry Waxman (D-Calif.) demanded proof and threatened to bring them before Congress. Waxman backed down when the companies provided proof.

You may recall that Obama’s thugocratic regime also threatened those holding the debt of General Motors and Chrysler during bankruptcy negotiations. “Agree to our settlement or risk getting nothing,” was the message. “Two hundred years of case law on bankruptcy be damned,” the thugocracy said.

The result of all this is approval ratings in the low 40s for Obama and single digits for Congress. The elites first caught wind of voter dissatisfaction during Town Hall meetings. No longer were they pleasant affairs attended by a few old codgers looking for a free cup of coffee. Now voters were expressing their discontent. The elites got scared and ducked and ran or hired thugs to protect them from their “malcontent” constituents. They grabbed video cameras or ordered them turned off. These embarrassing moments appeared on YouTube for any who were interested to see.

When special elections were held, incumbents and establishment candidates got trounced. Tea Parties grew stronger, their message resonated and spread. The large rallies in Washington, D.C., and around the nation frightened the regime.

The regime has responded. With corporate mainstream media’s audience falling precipitously the regime realized it was losing the message. People no longer turned to the alphabet soup news gatherers and the “All the news that’s fit to print” newspapers that all spread the same government propaganda. They sought their news from other sources: talk radio, the Internet.

So now the regime is pushing a bill to turn off the Internet. It also seeks a “fairness doctrine” so it can control radio content. Moves such as these will draw out the masses. If that happens the results won’t be pretty.

The Republican establishment is not immune from the public’s ire. In fact, the Republican Party is in the crosshairs of the Tea Party. Tea Party candidates are taking out the traditional “chosen” Republicans and reshaping the GOP in their image. The regime is surprised.

It shouldn’t be. The Republican establishment backs liberals like Mike Castle — a pro-abortion, pro-gun control, tax and spend liberal who calls himself a Republican — who as a Congressman sided with the Democrats more than Republicans. Tea Party conservatives figured it’s better to back a conservative with a chance she might lose in November than support a liberal Republican who votes for Democrat policies they’ve rejected.

So Christine O’Donnell whipped Castle for the Republican Senate nomination in Delaware. The Republican regime went into a snit, called O’Donnell names and cast doubts about her electability.

Karl Rove, the former advisor to President George W. Bush and architect of many of the Republican failures during the Bush years that resulted in the ascendancy of the current Democrat and Obama regime, was the poster child of regime arrogance on election night. He called O’Donnell nutty, and added other less-than-flattering adjectives. The National Republican Senate Committee said it would not be supporting her candidacy. What arrogance!

No matter. Tea Partiers responded. On Wednesday after her nomination, O’Donnell saw donations pour in from across the country. Her website crashed from the traffic.

Sensing trouble, the NRSC relented and quickly cut a check to her campaign.

The Republican establishment is slow to learn. The regime has a history of backing the wrong candidate: Charlie Crist over Marco Rubio, Senator Lisa Murkowski over Joe Miller, Trey Grayson over Rand Paul, Senator Bob Bennett (R-Utah) over Mike Lee, Rick Lazio over Carl Paladino. The regime doesn’t have it figured out yet.

“Establishment Republicans have no idea how livid Americans are with them,” Richard A. Viguerie told The Washington Examiner last Wednesday. “Republican leaders are in a panic because they have lost control of the Republican Party. Grassroots constitutional conservatives are inside the Citadel, and are poised to take over.”

The public is fed up. Democrats don’t yet realize it, but as soon as the Tea Party finishes cleaning up the parts of the Republican Party they can get to this election cycle, the Democrat purge will begin in earnest. That cleaning starts on Nov. 2. It won’t end there, regardless of the outcome. There will still be a lot of trash in Washington — Republican and Democrat — on the day after the first Tuesday after the first Monday in November. But Americans are as energized over the idea of a cleansing as they have ever been.

Democrats and Republicans alike face a tsunami in November the likes of which they still can’t imagine. Americans are ready to throw off the yoke of slavery they have toiled under for many years. The straws of control, taxes, government spending and regulations have finally broken the camel’s back.

The fascist regime is no longer stable. It knows only control, wars and more spending. So it continues to grow deficits, conduct wars without end, rattle sabers for more wars, put more regulations on food, push more “approved” harmful drugs on consumers, order more vaccinations, restrict access to natural health supplements and exercise more control over the public.

The regime calls for tax increases. This, too, is an effort at more control. It is legalized theft of your production.

Gold hit a record high last week. It is evidence the public is aware the regime is crumbling. The fiat system, instituted under the darkness of night 97 years ago, is failing. Throwing more fiat at the debt and deficits have succeeded only in creating more debt and greater deficits. The calculator the regime uses only adds and multiplies. The subtraction key doesn’t work. History shows this is a recipe for failure.

Store food for food and food for barter. Store water for sustenance. Store guns and ammunition for protection. Store gold and silver for wealth preservation. Prepare; for the regime is crumbling.

Thursday, September 16, 2010

How Hyperinflation Will Happen

Monday, August 23, 2010

by Gonzalo Lira

Right now, we are in the middle of deflation. The Global Depression we are experiencing has squeezed both aggregate demand levels and aggregate asset prices as never before. Since the credit crunch of September 2008, the U.S. and world economies have been slowly circling the deflationary drain.

To counter this, the U.S. government has been running massive deficits, as it seeks to prop up aggregate demand levels by way of fiscal “stimulus” spending—the classic Keynesian move, the same old prescription since donkey’s ears.

But the stimulus, apart from being slow and inefficient, has simply not been enough to offset the fall in consumer spending.

For its part, the Federal Reserve has been busy propping up all assets—including Treasuries—by way of “quantitative easing”.

The Fed is terrified of the U.S. economy falling into a deflationary death-spiral: Lack of liquidity, leading to lower prices, leading to unemployment, leading to lower consumption, leading to still lower prices, the entire economy grinding down to a halt. So the Fed has bought up assets of all kinds, in order to inject liquidity into the system, and bouy asset price levels so as to prevent this deflationary deep-freeze—and will continue to do so. After all, when your only tool is a hammer, every problem looks like a nail.

But this Fed policy—call it “money-printing”, call it “liquidity injections”, call it “asset price stabilization”—has been overwhelmed by the credit contraction. Just as the Federal government has been unable to fill in the fall in aggregate demand by way of stimulus, the Fed has expanded its balance sheet from some $900 billion in the Fall of ’08, to about $2.3 trillion today—but that additional $1.4 trillion has been no match for the loss of credit. At best, the Fed has been able to alleviate the worst effects of the deflation—it certainly has not turned the deflationary environment into anything resembling inflation.

Yields are low, unemployment up, CPI numbers are down (and under some metrics, negative)—in short, everything screams “deflation”.

Therefore, the notion of talking about hyperinflation now, in this current macro-economic environment, would seem . . . well . . . crazy. Right?

Wrong: I would argue that the next step down in this world-historical Global Depression which we are experiencing will be hyperinflation.

Most people dismiss the very notion of hyperinflation occurring in the United States as something only tin-foil hatters, gold-bugs, and Right-wing survivalists drool about. In fact, most sensible people don’t even bother arguing the issue at all—everyone knows that only fools bother arguing with a bigger fool.

A minority, though—and God bless ’em—actually do go ahead and go through the motions of talking to the crazies ranting about hyperinflation. These amiable souls diligently point out that in a deflationary environment—where commodity prices are more or less stable, there are downward pressures on wages, asset prices are falling, and credit markets are shrinking—inflation is impossible. Therefore, hyperinflation is even more impossible.

This outlook seems sensible—if we fall for the trap of thinking that hyperinflation is an extention of inflation. If we think that hyperinflation is simply inflation on steroids—inflation-plus—inflation with balls—then it would seem to be the case that, in our current deflationary economic environment, hyperinflation is not simply a long way off, but flat-out ridiculous.

But hyperinflation is not an extension or amplification of inflation. Inflation and hyperinflation are two very distinct animals. They look the same—because in both cases, the currency loses its purchasing power—but they are not the same.

Inflation is when the economy overheats: It’s when an economy’s consumables (labor and commodities) are so in-demand because of economic growth, coupled with an expansionist credit environment, that the consumables rise in price. This forces all goods and services to rise in price as well, so that producers can keep up with costs. It is essentially a demand-driven phenomena.

Hyperinflation is the loss of faith in the currency. Prices rise in a hyperinflationary environment just like in an inflationary environment, but they rise not because people want more money for their labor or for commodities, but because people are trying to get out of the currency. It’s not that they want more money—they want less of the currency: So they will pay anything for a good which is not the currency.

Right now, the U.S. government is indebted to about 100% of GDP, with a yearly fiscal deficit of about 10% of GDP, and no end in sight. For its part, the Federal Reserve is purchasing Treasuries, in order to finance the fiscal shortfall, both directly (the recently unveiled QE-lite) and indirectly (through the Too Big To Fail banks). The Fed is satisfying two objectives: One, supporting the government in its efforts to maintain aggregate demand levels, and two, supporting asset prices, and thereby prevent further deflationary erosion. The Fed is calculating that either path—increase in aggregate demand levels or increase in aggregate asset values—leads to the same thing: A recovery in the economy.

This recovery is not going to happen—that’s the news we’ve been getting as of late. Amid all this hopeful talk about “avoiding a double-dip”, it turns out that we didn’t avoid a double-dip—we never really managed to claw our way out of the first dip. No matter all the stimulus, no matter all the alphabet-soup liquidity windows over the past 2 years, the inescapable fact is that the economy has been—and is headed—down.

But both the Federal government and the Federal Reserve are hell-bent on using the same old tired tools to “fix the economy”—stimulus on the one hand, liquidity injections on the other. (See my discussion of The Deficit here.)

It’s those very fixes that are pulling us closer to the edge. Why? Because the economy is in no better shape than it was in September 2008—and both the Federal Reserve and the Federal government have shot their wad. They got nothin’ left, after trillions in stimulus and trillions more in balance sheet expansion—

—but they have accomplished one thing: They have undermined Treasuries. These policies have turned Treasuries into the spit-and-baling wire of the U.S. financial system—they are literally the only things holding the whole economy together.

In other words, Treasuries are now the New and Improved Toxic Asset. Everyone knows that they are overvalued, everyone knows their yields are absurd—yet everyone tiptoes around that truth as delicately as if it were a bomb. Which is actually what it is.

So this is how hyperinflation will happen:

One day—when nothing much is going on in the markets, but general nervousness is running like a low-grade fever (as has been the case for a while now)—there will be a commodities burp: A slight but sudden rise in the price of a necessary commodity, such as oil.

This will jiggle Treasury yields, as asset managers will reduce their Treasury allocations, and go into the pressured commodity, in order to catch a profit. (Actually it won’t even be the asset managers—it will be their programmed trades.) These asset managers will sell Treasuries because, effectively, it’s become the principal asset they have to sell.

It won’t be the volume of the sell-off that will pique Bernanke and the drones at the Fed—it will be the timing. It’ll happen right before a largish Treasury auction. So Bernanke and the Fed will buy Treasuries, in an effort to counteract the sell-off and maintain low yields—they want to maintain low yields in order to discourage deflation. But they’ll also want to keep the Treasury cheaply funded. QE-lite has already set the stage for direct Fed buys of Treasuries. The world didn’t end. So the Fed will feel confident as it moves forward and nips this Treasury yield jiggle in the bud.

The Fed’s buying of Treasuries will occur in such a way that it will encourage asset managers to dump even more Treasuries into the Fed’s waiting arms. This dumping of Treasuries won’t be out of fear, at least not initially. Most likely, in the first 15 minutes or so of this event, the sell-off in Treasuries will be orderly, and carried out with the idea (at the time) of picking up those selfsame Treasuries a bit cheaper down the line.

However, the Fed will interpret this sell-off as a run on Treasuries. The Fed is already attuned to the bond markets’ fear that there’s a “Treasury bubble”. So the Fed will open its liquidity windows, and buy up every Treasury in sight, precisely so as to maintain “asset price stability” and “calm the markets”.

The Too Big To Fail banks will play a crucial part in this game. See, the problem with the American Zombies is, they weren’t nationalized. They got the best bits of nationalization—total liquidity, suspension of accounting and regulatory rules—but they still get to act under their own volition, and in their own best interest. Hence their obscene bonuses, paid out in the teeth of their practical bankruptcy. Hence their lack of lending into the weakened economy. Hence their hoarding of bailout monies, and predatory business practices. They’ve understood that, to get that sweet bail-out money (and those yummy bonuses), they have had to play the Fed’s game and buy up Treasuries, and thereby help disguise the monetization of the fiscal debt that has been going on since the Fed began purchasing the toxic assets from their balance sheets in 2008.

But they don’t have to do what the Fed tells them, much less what the Treasury tells them. Since they weren’t really nationalized, they’re not under anyone’s thumb. They can do as they please—and they have boatloads of Treasuries on their balance sheets.

So the TBTF banks, on seeing this run on Treasuries, will add to the panic by acting in their own best interests: They will be among the first to step off Treasuries. They will be the bleeding edge of the wave.

Here the panic phase of the event begins: Asset managers—on seeing this massive Fed buy of Treasuries, and the American Zombies selling Treasuries, all of this happening within days of a largish Treasury auction—will dump their own Treasuries en masse. They will be aware how precarious the U.S. economy is, how over-indebted the government is, how U.S. Treasuries look a lot like Greek debt. They’re not stupid: Everyone is aware of the idea of a “Treasury bubble” making the rounds. A lot of people—myself included—think that the Fed, the Treasury and the American Zombies are colluding in a triangular trade in Treasury bonds, carrying out a de facto Stealth Monetization: The Treasury issues the debt to finance fiscal spending, the TBTF banks buy them, with money provided to them by the Fed.

Whether it’s true or not is actually beside the point—there is the widespread perception that that is what’s going on. In a panic, widespread perception is your trading strategy.

So when the Fed begins buying Treasuries full-blast to prop up their prices, these asset managers will all decide, “Time to get out of Dodge—now.”

Note how it will not be China or Japan who all of a sudden decide to get out of Treasuries—those two countries will actually be left holding the bag. Rather, it will be American and (depending on the time of day when the event happens) European asset managers who get out of Treasuries first. It will be a flash panic—much like the flash-crash of last May. The events I describe above will happen in a very short span of time—less than an hour, probably. But unlike the event in May, there will be no rebound.

Notice, too, that Treasuries will maintain their yields in the face of this sell-off, at least initially. Why? Because the Fed, so determined to maintain “price stability”, will at first prevent yields from widening—which is precisely why so many will decide to sell into the panic: The Bernanke Backstop won’t soothe the markets—rather, it will make it too tempting not to sell.

The first of the asset managers or TBTF banks who are out of Treasuries will look for a place to park their cash—obviously. Where will all this ready cash go?

Commodities.

By the end of that terrible day, commodites of all stripes—precious and industrial metals, oil, foodstuffs—will shoot the moon. But it will not be because ordinary citizens have lost faith in the dollar (that will happen in the days and weeks ahead)—it will happen because once Treasuries are not the sure store of value, where are all those money managers supposed to stick all these dollars? In a big old vault? Under the mattress? In euros?

Commodities: At the time of the panic, commodities will be perceived as the only sure store of value, if Treasuries are suddenly anathema to the market—just as Treasuries were perceived as the only sure store of value, once so many of the MBS’s and CMBS’s went sour in 2007 and 2008.

It won’t be commodity ETF’s, or derivatives—those will be dismissed (rightfully) as being even less safe than Treasuries. Unlike before the Fall of ’08, this go-around, people will pay attention to counterparty risk. So the run on commodities will be for actual, feel-it-’cause-it’s-there commodities. By the end of the day of this panic, commodities will have risen between 50% and 100%. By week’s end, we’re talking 150% to 250%. (My private guess is gold will be finessed, but silver will shoot up the most—to $100 an ounce within the week.)

Of course, once commodities start to balloon, that’s when ordinary citizens will get their first taste of hyperinflation. They’ll see it at the gas pumps.

If oil spikes from $74 to $150 in a day, and then to $300 in a matter of a week—perfectly possible, in the midst of a panic—the gallon of gasoline will go to, what: $10? $15? $20?

So what happens then? People—regular Main Street people—will be crazy to buy up commodities (heating oil, food, gasoline, whatever) and buy them now while they are still more-or-less affordable, rather than later, when that $15 gallon of gas shoots to $30 per gallon.

If everyone decides at roughly the same time to exchange one good—currency—for another good—commodities—what happens to the relative price of one and the relative value of the other? Easy: One soars, the other collapses.

When people freak out and begin panic-buying basic commodities, their ordinary financial assets—equities, bonds, etc.—will collapse: Everyone will be rushing to get cash, so as to turn around and buy commodities.

So immediately after the Treasury markets tank, equities will fall catastrophically, probably within the next few days following the Treasury panic. This collapse in equity prices will bring an equivalent burst in commodity prices—the second leg up, if you will.